This post contains affiliate links. As an Amazon Associate I may earn from qualifying purchases at no additional costs to you. Please see the Policies pages for more info.

Clear the Paper Clutter and Organize Financial Documents

Are your drawers overflowing with papers because you aren’t sure what you should keep and what you should trash? It’s easy to get caught up in the “I might need this someday” mentality with papers just as it is with anything else.

There are certain financial documents you should keep and some you can throw away after a certain period of time. Below is a guideline on how long you should keep your financial documents and tips for organization.

Documents That Are Currently Active

These documents only need to be kept for the lifespan of the document (until expiration date) or if you no longer own the property that it is linked to.

- Contracts

- Insurance Policies (home, auto, health, life)

- Property Records

- Stocks and Investments

- Car Title and Loan Information

- Home Improvement

- Unpaid Bills

Keep for One Month

- Sales Receipts – Keep receipts in a zipper pouch during the current month as you update your budget. Unless you need the proof of purchase for a warranty or proof of sale for tax purposes, you can throw out your receipts at the end of the month.

Financial Documents to Keep for One Year

- Paystubs (until you receive your W-2’s from your employer)

- Bank Statements

- Cancelled Checks

Financial Documents to Keep For 3 Years

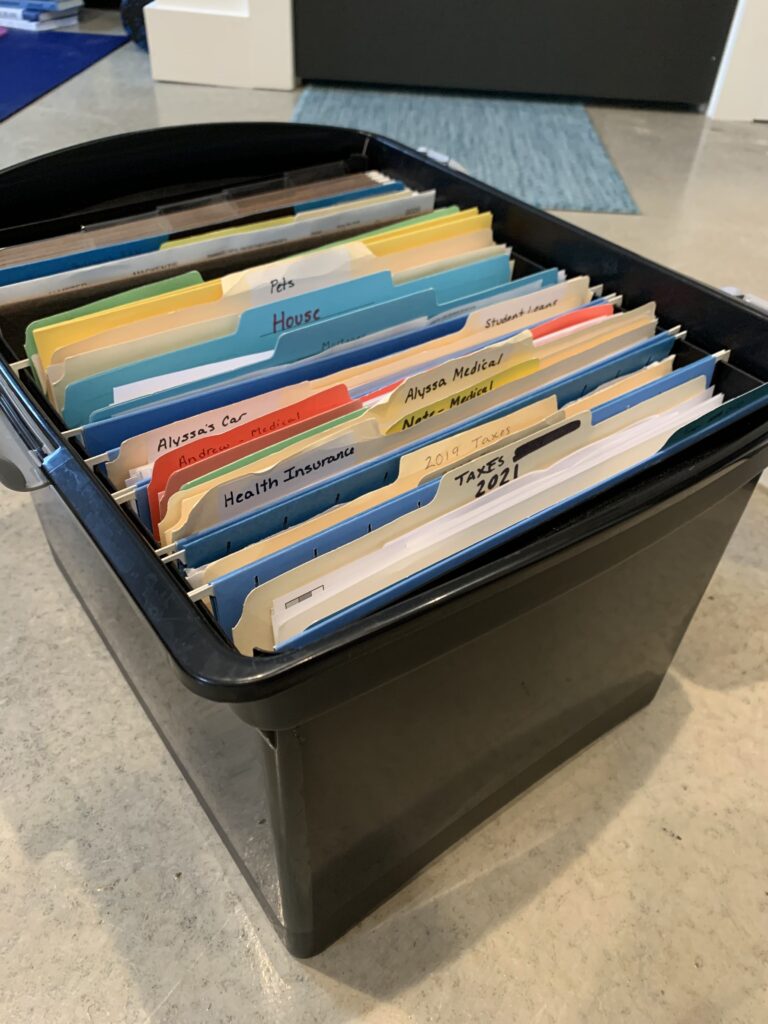

The following documents only need to be saved for the past 3 years. These can be kept in file folders and in a file cabinet or file box.

- Tax Documents and tax supporting documents (W-2’s, 1099’s, receipts, interest statements).

- Generally speaking you only need to keep 3 years of tax records unless there is a chance you may be audited or have a business. We have a file folder for each year and when we do our taxes, I throw out the the oldest year and reuse that folder for the upcoming year. Burn or shred your documents as they have personal information on them. For more details on keeping taxes, refer to the IRS’s website.

- Paid Medical Bills – I have a separate file folder for each family member.

- Cancelled Insurance Policies

- Records of a House Sale

- Sale of a Stock

Financial Records to Keep Forever

Here are the things that you should keep forever. Ideally you should store these in a fire and waterproof safe in case there is ever an accident in your home. You can purchase small document safes in the office supply section at Target or find one on Amazon.

- Wills

- Power of Attorney

- Birth Certificates

- Social Security Cards

- Marriage Certificates

- Adoption Papers

- Death Certificates

- Legal Documents

- Military Records

- Retirement Information

- Inheritance Documents

- Beneficiary Forms

- Debt Payoff Confirmation Letter (Student Loans, Private Loans, Car Loans, Mortgage, etc.)

Documents to Destroy

- Old Credit Cards (cut them up)

- Statements you can also access online. Save yourself some paper clutter and enroll in paperless statements for things like utility bills, mortgage statements, bank statements, etc.)

- Credit Card Offers

Organizing Your Financial Documents

Before you start organizing your papers, first go through all of them and decide what to keep and what to save. This will give you a better understanding of how much you actually need to keep and where to store them.

When I went through a large paper purge years ago, we went from a 2 drawer file cabinet to 1 small file box. We were keeping way more than we needed! Now it is much easier to find documents when we need them.

If you don’t already have a file cabinet then all you need is a plastic file box. They are cheaper and smaller than an entire cabinet. As explained above, your “forever” documents should be kept in a safe but everything else can be kept in a file box or cabinet.

Each year, make it a priority to purge old documents. I find that it’s best to do this right after you file your taxes. This will help you stay ahead of the paper clutter and keep your financial documents organized!

Conclusion

Organizing your financial documents is a simple yet powerful step toward taking control of your finances. By creating a clear system, you’ll save time, reduce stress, and make it easier to tackle your financial goals with confidence.

Whether you’re preparing for tax season, planning a major purchase, or simply looking to stay on top of your money, an organized approach ensures you’re ready for whatever comes your way.

Start small, be consistent, and enjoy the peace of mind that comes with having everything in its place. Remember, a little effort today can save you a lot of hassle tomorrow!

How do you organize your financial documents? Comment below!