We all have major purchases throughout our lives but not all of us are prepared to use cash instead of a credit card for those larger items. Having a sinking fund helps you prepare for those things so that you don’t have to use a credit card and go further into debt.

In this post I will go over what a sinking fund is, what it is not and how to start one for each of your savings goals.

What is a Sinking Fund?

A sinking fund is a savings plan for a specific item. It allows you to save a little each month for a larger purchase so that you have cash on hand. You can have one sinking fund or several depending on your goals. Some examples of a sinking fund include:

- Christmas gifts

- New vehicle or repairs

- Wedding

- Down payment on a house

- Home upgrades and repairs

- Vacations

- Vet bills

- School supplies

- Baby furniture

What A Sinking Fund Is Not

It is not a general savings account. You can keep your sinking fund in your savings account but the money for your sinking fund is directly tied to the category you planned on.

It Is Not An Emergency Fund

It is not an emergency fund. An emergency fund is for unplanned expenses, such as an unexpected car repair or to cover household expenses if you lose your job. A fully funded emergency fund should have 3 – 6 months worth of living expenses.

It Is Not a Long-Term Savings Plan

Sinking funds are short term so don’t expect earning any significant interest if you keep it in a savings account. For long-term savings such as college savings or retirement, talk to a financial advisor about investing in mutual funds where interest rates are higher.

How to Start a Sinking Fund

1: Decide What Funds You Want To Set Up

Think about upcoming events that you need to start saving for. Some may be yearly events like Christmas and birthdays and some might be special occasions like weddings. Write down the dates of these events or when you would like to have the money by.

2: Where Will You Save Your Money

You have a couple options on where to keep your sinking fund. I would suggest to not keep it in your everyday checking account. If it’s in your checking account it can easily be forgotten and used for something else.

Your first option is to withdraw cash each month and keep it in a safe place in your home. A fireproof safe would be the best place for this.

If you don’t want to keep cash in the house then you can use your savings account. Make sure you are tracking your sinking fund so that you can differentiate it from your other savings. One benefit of keeping it in a savings account is to set up automatic transfers from your checking to savings. This ensures that the money will be saved each month without you having to think about making the transfer each time.

3: Calculate How Much You Need To Save Each Month

Once you know what kind of funds you need and your goal amount, you will need to calculate how much to save each month. To do this take the total amount you want to save and divide it by the number of months you have until your deadline. For example, if you are planning to buy a $200 bridesmaid’s dress for your friends wedding and you have 3 months until you have to pick out a dress you will need to save $67 a month ( $200 / 3 = $66.67 ). Be sure to add that amount to your monthly budget.

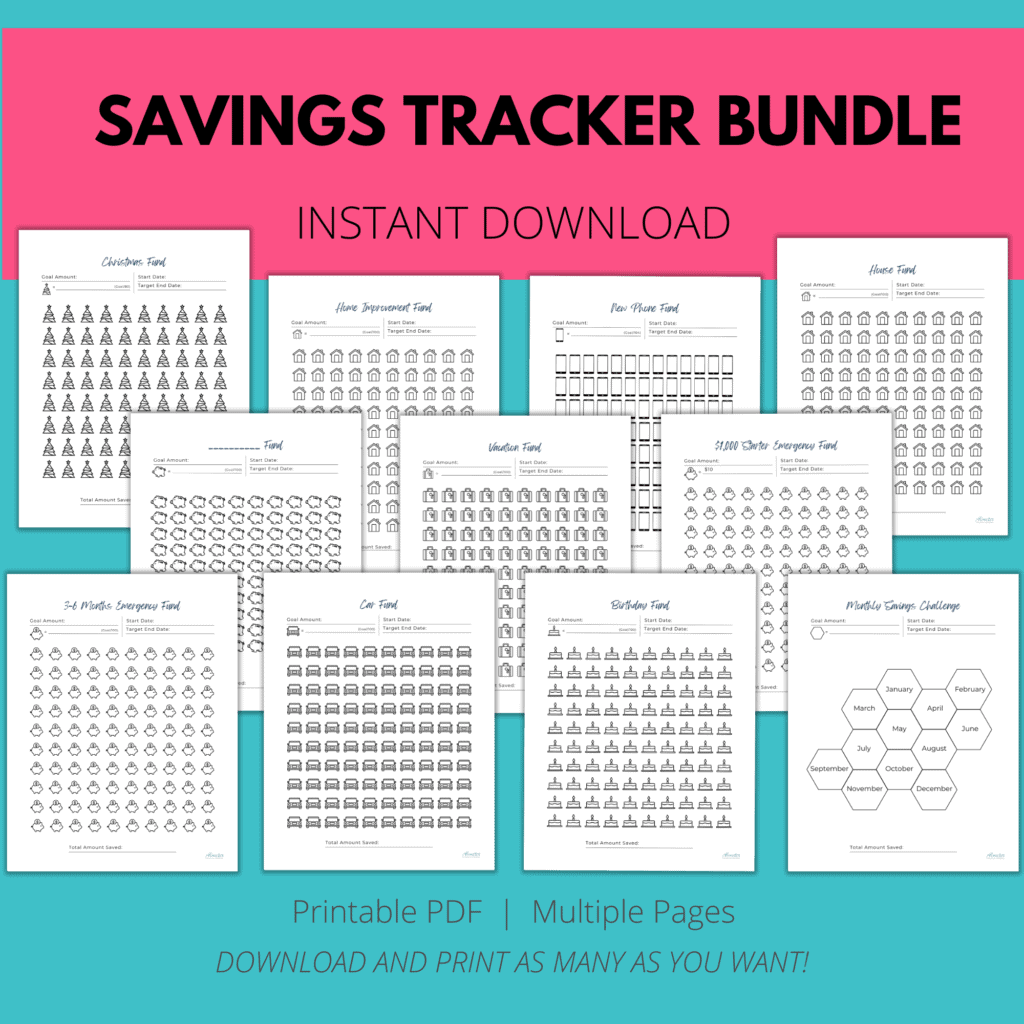

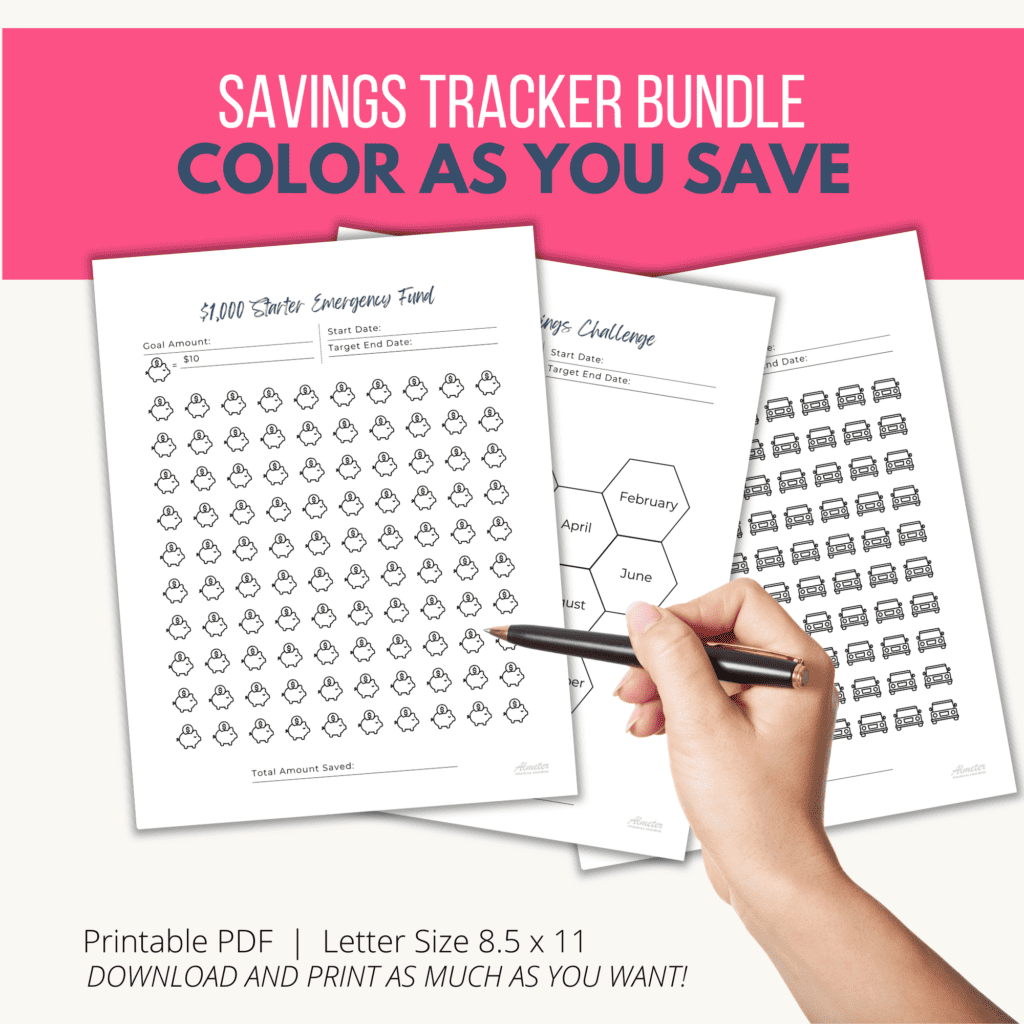

Use a Savings Tracker to Stay Motivated

Your sinking funds are an important piece of your money plan to stay out of debt. Having the cash ready for your purchase will give you peace of mind on bigger ticket items. A visual tracker can help you stay motivating by seeing your progress towards your end goal. The Savings Tracker Bundle is a downloadable printable that includes 15 different trackers that you can color in as your money grows!

Related Articles

Dave Ramsey Baby Steps to Financial Peace

Organize Your Money With These Common Budget Categories

How to Set Short Term Financial Goals

Financial Safety Net: The Power of an Emergency Fund in Uncertain Times